Investment Risk and Taxation

Introduction to the Investment Risk and Taxation Certification

Develop the essential skills and expertise needed to excel in the dynamic financial services sector. The Investment Risk and Taxation Certification is a comprehensive programme designed to equip aspiring professionals with the knowledge and capabilities to succeed as trusted advisors in the industry. Gain a solid foundation in investment risk management and taxation principles, preparing you for a rewarding career in finance.

Call Today! +44 20 8129 4023

Flawlessly Refining Careers

The Investment Risk & Taxation Certificate

Introduction to the Investment Risk and Taxation Certification

The Introduction to Investment Risk and Taxation Certification is both a critical component of the Investment Advisor Certification (IAC) programme and a valuable standalone certification. Designed for investment banking and financial services professionals, it delivers advanced knowledge in managing investment risks and understanding taxation principles essential for success in the financial industry.

As Module 2 of the IAC, this certification builds on foundational expertise, equipping participants with the tools to navigate complex financial scenarios confidently. It delves into investment risk assessment, mitigation strategies, and the intricacies of taxation frameworks, preparing you to excel in a highly competitive sector.

For those pursuing it as a standalone certification, the programme offers a comprehensive curriculum tailored to enhance your career prospects. Whether you are looking to deepen your expertise or gain specialised skills in financial risk and taxation, this certification is an excellent choice.

This certification reflects more than technical proficiency—it showcases your dedication to professional integrity and your ability to meet industry standards. It also connects you with a distinguished network of professionals in investment banking, wealth management, and financial advisory services.

Whether pursued as part of the IAC or independently, the Introduction to Investment Risk and Taxation Certification positions you as a trusted financial professional, opening doors to leadership roles and opportunities for career advancement in the fast-paced financial services industry.

Why Choose the Investment Risk and Taxation Certificate

- Comprehensive Curriculum: A deep dive into UK financial regulations, investment risk management, taxation, and derivatives.

- Practical Expertise: Learn actionable strategies to optimise returns, mitigate risks, and safeguard client assets.

- Industry-Recognised Certification: Equip yourself with a globally respected credential to elevate your career.

- Commitment to Professionalism: Build trust through adherence to ethical and regulatory standards.

Sleek & Stylish Profiles For Our Students to Showcase Their Professionalism

Aspiring to Succeed in Investment Banking or Financial Services?

The Investment Risk and Taxation Certification, offered by Financial Regulation Courses, is a comprehensive e-learning programme designed to equip professionals and aspiring financial experts with the essential skills and knowledge to excel in the fast-paced financial sector. Serving as both a standalone certification and Module 2 of the Investment Advisor Certification (IAC) programme, this course focuses on investment risk management, taxation principles, and their application in real-world financial services.

This certification prepares you to tackle complex financial scenarios while adhering to ethical standards and regulatory compliance. It is an excellent pathway for those seeking to advance in roles like investment advisory, wealth management, and corporate finance, providing the expertise to thrive in competitive fields such as investment banking and financial consulting.

Enhance Your Career with a Professional Profile

Your Investment Risk and Taxation Certification deserves to be showcased, and a polished, professional profile is the perfect platform to highlight your achievements. This dynamic profile enhances your visibility within the financial industry, presenting your expertise and commitment to professional excellence.

Why a Professional Profile Adds Value:

- Stand Out in the Market: Highlight your certification to distinguish yourself in a competitive financial sector.

- Gain Employer Confidence: A verified profile reinforces your credibility with clients, employers, and collaborators.

- Expand Your Network: Use your profile to connect with industry leaders, showcase your skills, and explore new career opportunities.

Your Certification, Your Competitive Edge

The Investment Risk and Taxation Certification is more than a stepping stone—it’s a testament to your expertise and dedication to excellence in the financial services sector. Whether pursued independently or as part of the Investment Advisor Certification (IAC), this certification positions you for career advancement, professional recognition, and success in the dynamic world of finance.

Take the next step in your career and make your mark in the financial industry with a certification that sets you apart.

Exam Fraud Prevention

Integrity and Security in the Investment Risk and Taxation Certification

At Financial Regulation Courses, the Investment Risk and Taxation Certification is more than a testament to your expertise in investment risk management and taxation principles—it is a symbol of integrity and trust in the financial services industry.

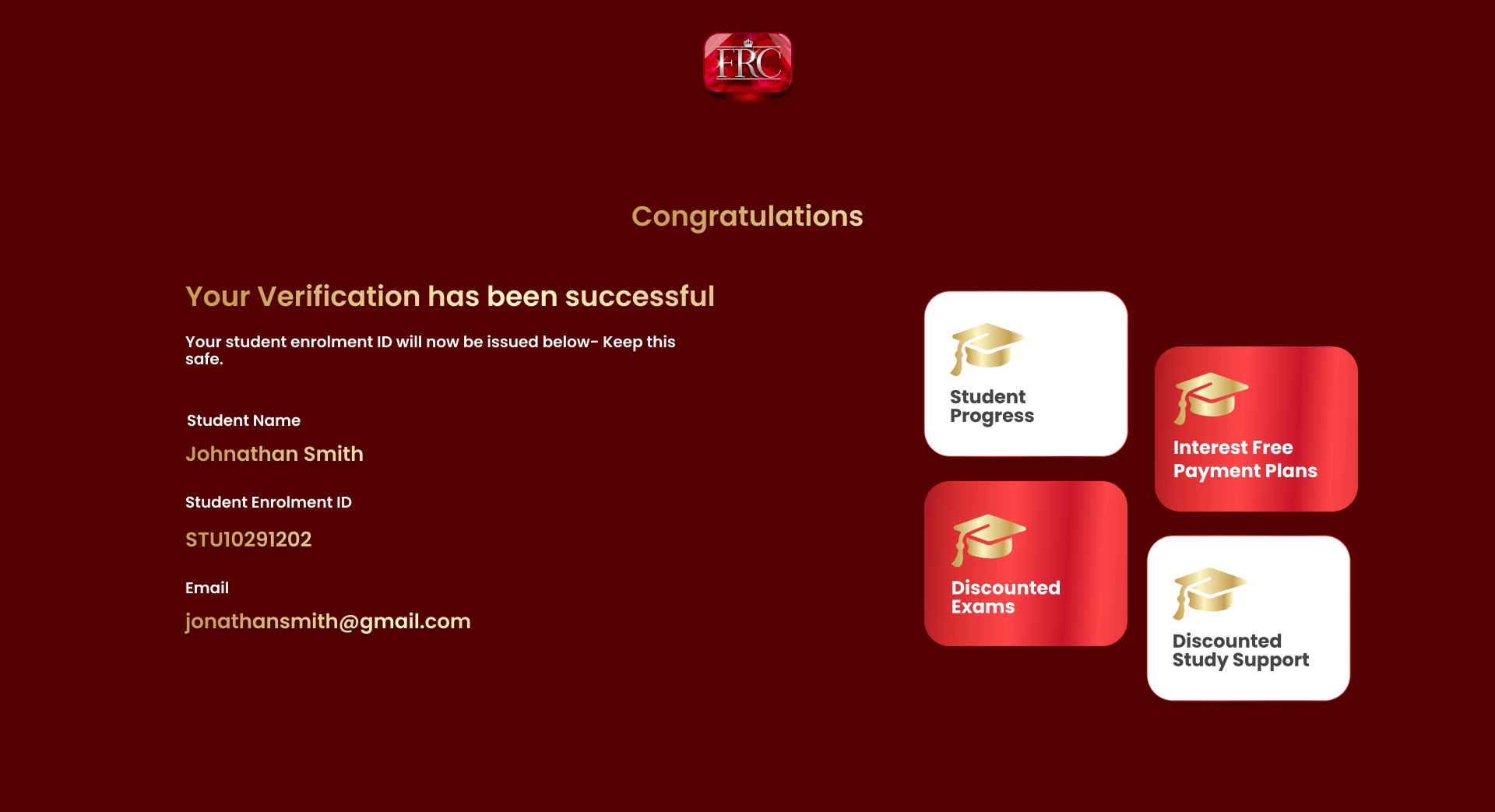

Our rigorous Know Your Customer (KYC) verification process ensures that only verified students enrol in the programme, safeguarding the value of the certification and maintaining the highest standards of professionalism.

This certification is designed with advanced fraud-prevention measures, including robust verification protocols and secure exam monitoring systems. These technologies ensure that every certification reflects genuine effort, verified knowledge, and a commitment to ethical practices. Employers and financial institutions can have full confidence in the authenticity of your certification, knowing it represents proven expertise and adherence to industry standards.

By completing the KYC process, students demonstrate their dedication to transparency and professional integrity. This commitment reinforces the credibility of their credentials, making the Investment Risk and Taxation Certification a trusted benchmark of excellence recognised globally.

With these fraud-proof measures in place, this certification is more than an accomplishment—it is a hallmark of your integrity, professionalism, and capabilities in the competitive financial sector.

Advance Your Career with the Investment Risk and Taxation Certificate

Gain Recognition with the Investment Risk and Taxation Certification

Financial institutions value professionals who hold the Investment Risk and Taxation Certification, recognising them as trusted experts equipped with the critical skills needed to thrive in today’s fast-paced financial markets.

Begin your journey toward excellence with this essential certification, a key component for success in any financial services or investment banking programme. Enhance your credentials, stand out in a competitive industry, and open doors to global opportunities while showcasing your dedication to professional growth and industry standards.

Your pathway to success in finance and financial institutions starts here—take the next step toward advancing your career today!

A Certification That Redefines Success

The Investment Risk and Taxation Certification: Your Pathway to Success

The Investment Risk and Taxation Certification is a globally respected programme designed to empower individuals at every stage of their careers in the financial services sector. Balancing accessibility with in-depth content, this certification equips participants with the critical skills and knowledge needed to excel in roles related to investment risk management, taxation, and financial advisory.

Whether you’re a recent graduate eager to secure sought-after opportunities in the financial industry or an experienced professional aiming for promotions and career growth, the Investment Risk and Taxation Certification provides the expertise you need to thrive. By mastering key principles in taxation, investment risk, and compliance, this certification positions you as a standout professional in the competitive financial job market. It also serves as a gateway to leadership roles and enhanced professional credibility.

This certification is tailored to address the evolving demands of the financial sector, ensuring you remain ahead of industry trends. Employers and financial institutions highly value certified professionals for their proven ability to navigate complex scenarios and deliver exceptional results.

Take your career to new heights by earning the Investment Risk and Taxation Certification. Unlock unparalleled opportunities and demonstrate your commitment to excellence in the dynamic world of finance.

Frequently Asked Questions

How Can I enrol?

Enrolling in the Investment Risk and Taxation Certification through Financial Regulation Courses is a straightforward process designed to accommodate both aspiring and seasoned financial professionals. Visit the Official Website: www.financialregulationcourses.com to begin your certification journey.

Are Exams on Fixed Dates?

With our advanced facial recognition software and biometric verification systems, combined with our KYC process to ensure exam integrity, our students have the flexibility to take their exams at any time, day or night, offering unparalleled convenience without compromising security or professionalism.

How do I get a Digital profile?

To access a digital profile, you must join our membership programme, which operates separately from course enrolment. For more information and to join, please visit our Membership Page.

How much is the Risk and Tax?

For full pricing and student discounts, please visit Financial Regulation Courses.

Can I study at my own pace?

Yes this is a self paced learning programme designed to work around your existing schedule.

If I pay in full must I still do my KYC?

Yes, even if you pay for your course in full, you are still required to complete the Know Your Customer (KYC) process for exam verification. This mandatory step ensures the integrity and security of our certification programmes by verifying the identity of all candidates. The KYC process is essential to prevent exam fraud and maintain the high standards of our Certifications. Please note that the KYC verification must be completed personally by the student preparing for the exam; third-party payments are not accepted.

Open Doors to Career Opportunities: More Interviews, More Promotions

Stand out as a true professional in the dynamic world of investment banking. With our Professional Profile, showcase your expertise, achievements, and commitment to integrity, ethics, and professionalism of the highest standards.

Position yourself as an industry leader by demonstrating your dedication to ethical practices and excellence. Elevate your professional standing, build trust with employers, and unlock opportunities that set you apart in the competitive financial services landscape.

Lead the Future of Finance—Become an Investment Advisor Today

Step into a dynamic career where your expertise shapes financial futures and drives global success. The Investment Risk and Taxation Certification is your gateway to becoming a trusted leader in the financial services industry, equipping you with the knowledge, integrity, and skills to navigate the ever-evolving financial landscape.

As an Investment Advisor, you’ll be at the forefront of investment strategy, portfolio management, and client success. This prestigious certification empowers you to guide individuals, businesses, and institutions towards achieving their financial goals with confidence and precision.